Professor Miranda Brawn, recent winner of two awards for her inspirational leadership, is to launch a drive to promote gender equality and empower women in the UK and globally.

Prof Brawn is president of The Miranda Brawn Diversity Leadership Foundation (TMBDLF) which she founded eight years ago with a mission to eliminate diversity, equity and inclusion gaps in the professional workplace through education and empowerment for future leaders.

Her new scheme, TMBDLF Global Gender Human Rights, has the goal of advancing women’s and girl’s human rights and eliminating gender discrimination and associated intersectional discrimination.

Due to launch officially on International Women’s Day, Friday 8 March, its aim is to “inspire inclusion”.

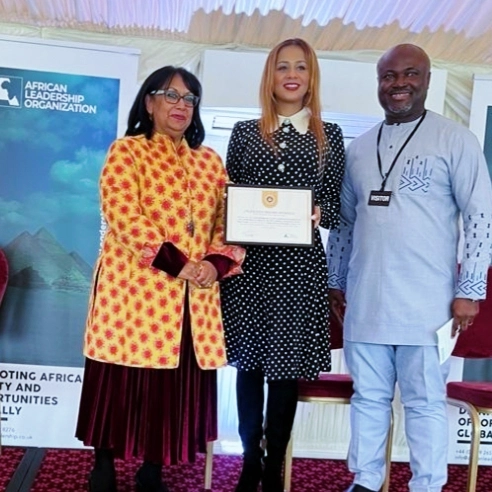

Prof Brawn was recently recognised with the African Leadership Organisation’s Top 50 Afro-Caribbean Leadership Award at a ceremony in the House of Lords.

Prof Miranda Brawn with Chair of UN Women UK Baroness Sandy Verma at the House of Lords in January 2024 after winning the Top 50 Afro-Caribbean Leadership Award 2023.

The award showcases inspirational leaders and change-makers who have positively influenced their local communities and the larger UK and global society, changing negative narratives often linked to minorities and people of colour.

Prof Brawn was also listed among the Top 100 UK Influential People 2024 for all nationalities across the UK.

The Top 100 programme highlights “truly influential people” who affect society and who are making the world a better place.

TMBDLF Global Gender Human Rights (TMBDLF GGHR) aims to fight injustice against women and girls, and support women and girls who face discrimination, stigma, violence and criminalisation.

The programme will encourage social, educational and behaviour change by working with women-led organisations like Action Aid and other gender-based charities as well as granting scholarships.

It complements Prof Brawn’s other roles in this sphere which include being a UN Women UK delegate and ActionAid UK Arise Fund advisory board member.

“Having had a history of supporting victims of sexual and gender-based violence, I have seen first-hand the difference that support can make to the lives of marginalised women,” said Prof Brawn.

“I am seeking to help support the change of the current status quo by allowing women and girls to claim their equal rights. Around the world and in the UK, women and girls face pervasive discrimination and violence.”

An international lawyer since 2011, she said she is keen to use her legal knowledge and background to fight outdated laws that criminalise “immoral” behaviour by women.

“Pervasive practices such as child marriage and sexual violence are lacking a concerted supportive response,” she said.

“Many women and girls face discrimination in the administration of justice or lack the means to access the system.

“Although governments around the world have promised to protect women in their constitutions and treaties, many women are not able to use the law to claim their rights. This includes right here in the UK!”

Prof Brawn said her advocacy work for equality, diversity and human rights spans nearly three decades, including her previous role as an equality commissioner for Lambeth.

An innovative scholarship “Global Gender Human Rights” will be added to The Miranda Brawn Diversity Leadership Foundation’s existing list of scholarships which include mentoring and funding.

It will help encourage the next generation of human rights leaders in advocacy work for girls and women “in education, the workplace and so much more,” said Prof Brawn.

The ninth Miranda Brawn Diversity Leadership Annual Lecture in 2024 will be titled “Global Gender Human Rights”.

Prof Brawn said research highlights the importance of her initiative. The United Nations’ gender snapshot in 2023 showed that urgent and determined action is needed to realise true gender equality as part of the update on the UN’s 17 Sustainable Development Goals.

“At the current rate, we risk leaving more than 340 million women and girls in abject poverty by 2030, and an alarming 4% could grapple with extreme food insecurity by that year,” she said.

“Growing vulnerability brought on by human-induced climate change is likely to worsen this outlook, as many as 236 million more women and girls will be food-insecure under a worst-case climate scenario.

“The gender gap in power and leadership positions remains entrenched and, at the current rate of progress, the next generation of women will still spend on average 2.3 more hours per day on unpaid care and domestic work than men.

“No country is within reach of eradicating intimate partner violence, and women’s share of workplace management positions will remain below parity even by 2050.

“Fair progress has been made in girls’ education, but completion rates remain below the universal mark. With the clock ticking, urgency mounts. Even with significant progress in certain sectors, as we approach the halfway mark of the 2030 Agenda for Sustainable Development, monumental challenges remain.

“The global pandemic, conflict, the climate crisis, and a harsh backlash against women’s sexual and reproductive health and rights are further diminishing the outlook for gender equality.

“Violence against women remains high; global health, climate, and humanitarian crises have further increased risks of violence, especially for the most vulnerable women and girls; and women feel more unsafe than they did before the pandemic.

“In countries as diverse as Afghanistan and the US, women and girls now have fewer rights than their mothers and grandmothers did.

“Gender equality, besides being a fundamental human right, is essential to achieve peaceful societies, with full human potential and sustainable development. Moreover, it has been shown that empowering women spurs productivity and economic growth.

“Every day, in every country in the world, women are confronted by discrimination and inequality.”

Email The Miranda Brawn Diversity Leadership Foundation – info@tmbdlf.com – for more information about the TMBDLF Global Gender Human Rights”initiative.