https://www.bloomberg.com/news/audio/2021-10-08/miranda-brawn-on-tesla-s-agm-e-bus-market-kuid8sgu

Nurole’s interview with Dr Miranda Brawn on launching the UK’s first Black Women on Boards (BWOB) initiative

Dr Miranda K. Brawn talks about launching the UK’s first ‘Black Women on Boards’ initiative, reverse mentoring and how board culture can enable greater diversity and inclusion

Dr Miranda K. Brawn MBA FRSA is a British businesswoman, experienced non-executive director, board advisor, lawyer and philanthropist.

She started her banking career as one of the first women of colour on London’s trading floor and went on to hold a number of senior leadership roles at JP Morgan, Goldman Sachs and other top global financial institutions. She’s held multiple board roles within the public, private and third sectors including the Crownsavers Credit Union, the Black Cultural Archives and Lambeth Council. She currently sits on the board of electric vehicle manufacturer Switch Mobility Limited and The Honourable Society of Lincoln’s Inn’s Investment Committee and Social Mobility Committee as part of the Bar Representation Committee. She is also a Bloomberg News TV and Radio expert contributor.

In January 2016, Miranda launched The Miranda Brawn Diversity Leadership Foundation. Its mission is to eliminate the diversity, equity and inclusion gaps in the professional workplace through education and empowerment for future diverse leaders. The charity launched the UK’s first diversity leadership lecture event series and, in 2021, its first Black Women on Boards” (BWOB) initiative.

There seems to be more talk than ever about diversity at the moment – why does real change still feel so slow?

One of the major obstacles is that inclusion still does not make commercial sense to a lot of leaders, despite the fact that a diverse, open and supportive work culture has been proven to be more dynamic and inspire greater innovation.

Reinventing company culture and changing employees’ attitudes and mindsets cannot be achieved overnight, but is urgently required. These initiatives require significant time and investment to get off the ground and become embedded into company culture. It is also a sensitive and emotive topic that many people would rather avoid.

Where should organisations start?

The focus has to be on action and transparency now. There needs to be a strong and consistent message from the leadership on its commitment to DE&I – without this, the message will become confused and lose momentum. More bravery is required for faster change to take place.

In turn, this strong voice empowers people throughout the business to support one another and embody these messages, which has the potential to transform company culture. Leaders need to be held accountable to deliver on DE&I objectives, otherwise these initiatives can fall by the wayside.

Reviewing and adapting processes to make sure they encourage fairness is an important step on this journey. How companies manage and recruit staff has been proven to stifle diversity.

When did you start thinking about launching an initiative focused on boards?

I have wanted to launch this sort of initiative for many years as there has been an obvious gap at board and senior level management for years.

We wanted to kickstart International Women’s Month by raising the awareness that more needs to be done to hire more women with Black African and Caribbean heritage in the boardroom, especially within publicly listed companies.Our “Black Women on Boards” (BWOB) initiative includes an innovative scholarship programme and reverse mentoring programme with senior leaders.

How important is it to have diversity initiatives aimed at specific groups (like black women) as opposed to say all underrepresented groups?

Because although the number of female directors at FTSE-100 firms has increased by 50% in the last five years, it’s mostly white women.

BoardEx data reveals that only around 3% of female board-level roles are held by women of Black, Asian or minority ethnic (BAME) heritage in the UK’s 350 largest listed companies. These are mostly women from Asian and other minority ethnic backgrounds.

Recent research also highlights that for the first time in six years, there are no Black Chairs, CEOs or CFOs in FTSE 100 companies. There is an urgent need to address this unfair and unjust hiring gap with women and men from a Black African and Caribbean heritage.

Tell us about reverse mentoring and why it is so important.

It compliments our existing mentoring programmes by allowing our current students and alumni to act as mentors to senior leaders. They will share their perspective and experiences and, in doing so, help those leaders think about diversity, equity and inclusion.

This is so important because everyone can learn from each other. It enables better inclusion and improves diversity in the talent pipeline. This improves empathy and mitigates unconscious bias. This also drives culture change and gives leaders the opportunity to stay ahead of the trends through junior employees and mentees.

What practical steps can Chairs take to diversify their hiring processes?

Chairs should be looking at the skill sets that they would ideally want on the board, and then the skill sets they have. By identifying the gaps, they can use this as an opportunity to build in diversity – remembering the inclusion part once board members are hired.

A practical step for Chairs is to simply look in different places. There are numerous leaders like myself who have access to a large diverse network of senior leaders looking for board positions. Tap into these people and their diverse networks. Make sure that recruiters are changing their processes to source diverse candidates. In 2022, you cannot afford to say that you cannot find the diverse talent, because there are great diverse leaders out there who are board-ready, like myself.

As well as hiring, are there elements of board culture that need to change to encourage more diversity?

Research has found that diversity does not guarantee a better performing board – the culture affects how well it performs. Diversity does not matter as much on boards where members’ perspectives are not regularly elicited, respected and valued. To make diverse boards more effective, boards need to have a more egalitarian culture — one that elevates different voices and integrates contrasting insights.

What advice would you give to someone who is thinking about applying for their first board role?

Having a wealth of experience is a clear advantage. But when applying for non-executive roles, only use 25% of your time to detail what you did in the past. Reserve the other 75% to focus on the ‘so what?’. You need to give the most weight to explaining how you will apply your experience to the board and how you will add value.

Be mindful that not everyone on the board has to bring everything. You can offer depth in one or two areas and still be a phenomenal director. You need to pitch what you will bring to that particular board and remember you may contribute in different ways to different organisations.

More importantly, do not give up, and reach out to existing board directors for help and advice. There are a lot of wonderful and supportive board directors who are happy to help you to find your first board role.

Dr Miranda Brawn in Forbes Magazine on ESG including DE&I – 2021

Switching To The Right Approach

The recent appointment of Dr. Miranda Brawn to the position of Independent Non-Executive Director (iNED) at Switch Mobility’s Corporate Board brings together these interlinked strands: carbon-neutral transport solutions, corporate governance, regulatory and risk management, and DE&I and ESG agendas.

In a freewheeling discussion, Dr. Brawn shared her views on how the electric vehicle industry can spearhead DE&I and ESG agendas as part of the larger sustainability charter. She emphasized that electric vehicles, which are inherently carbon-neutral, are the future of mobility and will be key to combating climate change challenges. That said, the mobility ecosystem will need to embrace every aspect of sustainability in order to realize socially, economically and environmentally coherent practices and create real, long-term value.

Talking of the importance of embracing sustainability from a holistic perspective, Dr. Brawn highlighted that ESG-driven investments into clean technology solutions and environmentally conscious practices represent only one side of the sustainability coin. The other is DE&I which leads with socially inclusive and equitable approaches, backed by governance commitments.

Elaborating on this idea, she added that actively encouraging work force diversity –whether in terms of gender or race, disability or sexual orientation – across all levels of the organization, particularly at top decision-making levels, can strengthen resilient & responsible, collaborative & creative, inclusive & innovative growth.

For Dr. Brawn, the idea of inclusiveness extends even further to developing products and services that are suitable for all. This could, for example, inform the designs of next generation vans and buses that can be driven by both men and women and by both old and young. For the perennially driver strapped commercial fleet industry, new vehicle design and technology could encourage a new legion of drivers, young and old, to get behind the wheel. Switch is already working towards this goal with the new vehicle design & engineering of its next generation vans.

Dr. Brawn sees technology as catalyzing other positive social impacts in the form of in-vehicle advanced driver assistance systems and health, wellness and wellbeing features that targeted greater comfort, convenience and safety for vehicle occupants/drivers based on their individual, rather than any perceived collective, needs.

Dr Miranda Brawn is the opening keynote speaker for ‘Women Automotive Network’ on International Women’s Day 2022

Skoda’s Member of the Board, Maren Graef, and Dr Miranda Brawn are just TWO of the fantastic speakers confirmed for next month’s Spring Meetup.

LONDON, UK, February 21, 2022 /EINPresswire.com/ — Skoda’s Member of the Board, Maren Graef, and Dr Miranda Brawn Independent Non-Executive Director of Switch Mobility Ltd are just TWO of the fantastic speakers confirmed for next month’s Spring Meetup (which is being hosted by the Women Automotive Network).

Unlike previous WAN keynote sessions, Maren will be taking to the stage, and hosting an interactive ‘Ask a Leader’ session, where she’ll be answering questions from the audience. Dr Miranda Brawn will be addressing how as an industry, we can ‘drive more women to the automotive boardroom.’

A result of a recent poll (which was taken during the Women Automotive Network’s Winter Meetup in 2021) indicated that “only 30.1% of women in the industry feel as though their career goals have the correct internal support.”

Therefore, at next month’s Spring Meetup, there will be a series of specialist, dedicated career and leadership workshops, personal success stories from automotive female leaders, and… speed networking for ALL attendees, – to drive career goals and support in the industry.

Other speakers include Fedra Ribeiro (COO, Mobilize, Renault Group) who will be delivering a talk on ‘Growing New Mobility Business from a Historical core.’

The event will close with a Panel Discussion focus on ‘Leadership, Career Development, Being a Woman in the Automotive Industry,’ with contributions from Penny Weatherup (People Director, Volkswagen Group United Kingdom Limited), Ella Podmore (IET Young Woman Engineer of the Year 2020; Materials Engineer, McLaren Automotive Ltd), and Katharina Hopp, Senior Vice President Business Team Mobility Solutions, Robert Bosch GmbH.

Sponsors Include: McKinsey & Company, Capgemini Invent, Henkel, Flex, Harman, AkzoNobel, Novelis, Micron, Vitesco, Daimler Truck AG, Audi, Ford. Altair, Leoni, Tuxera, Blue Yonder, ITW, and Skoda.

“We are so excited to hold our annual Spring Meetup event once again,” said Stephanie May, the Women Automotive Network’s Commercial Director, and the Spring Meetup’s organiser.

“Last year, 250+ delegates attended, whereas this year, we’re expecting a much bigger turnout, and we can’t wait to celebrate International Women’s Day once again, to support leadership and diversity in the automotive industry, and to bring professionals closer together,” added Stephanie.

About The Women Automotive Network:

The Women Automotive Network is the fastest-growing platform for automotive diversity and technology discussions, – made possible by their events, content, mentorship scheme, and their rapidly growing community of 8000+ members on LinkedIn.

For more information visit: https://womenautomotivesummit.com

Applications for The Miranda Brawn Diversity Leadership Scholarships 2022/23 now open

PRESS RELEASE: 1ST MARCH 2022

The Miranda Brawn Diversity Leadership Foundation (TMBDLF)’s scholarship application process opened on 1st March 2022.

The mission of this registered charity is to eliminate the diversity, equity and inclusion gaps in the professional workplace by educating, empowering and inspiring out next generation of diverse student leaders. The aim is to make a real difference in the lives of our next generation by giving them a ticket to the lottery of life.

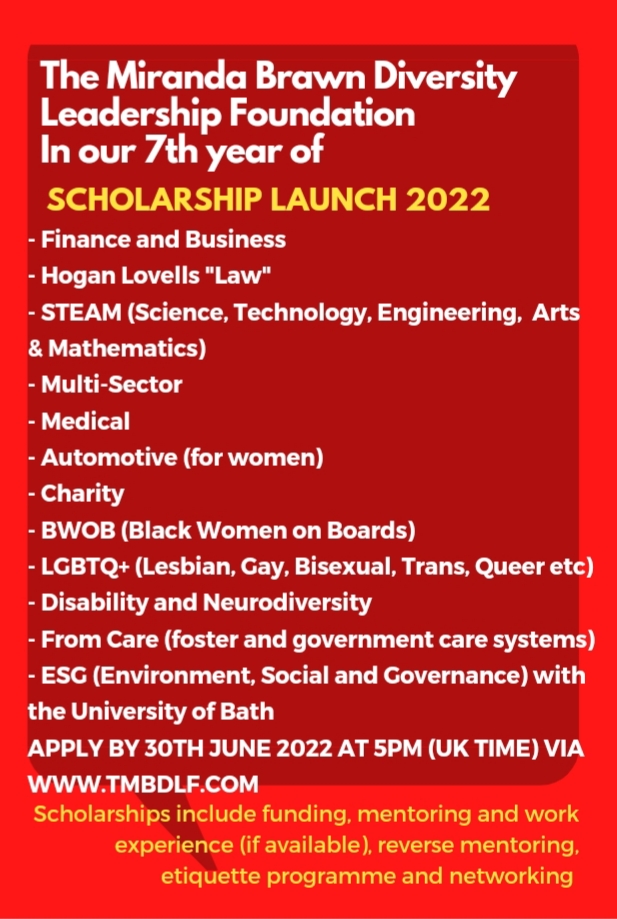

There are at least 12 scholarships available to young people up to ages of 30 years from diverse backgrounds. Set up on the 4th January 2016, this is The Miranda Brawn Diversity Leadership Foundation (TMBDLF)’s seventh year.

Applicants must be at school, college or university on a full-time basis and achieving good grades with an interest in diversity. Applications close on 30th June 2022 at 5pm (London time).

The scholarship award includes £500 to £1,000 in funding, mentoring and reverse mentoring with leaders in their field, work experience (if available and pending COVID restrictions) with leading UK organisations, etiquette educational training, networking, graduation group mentoring lunch and VIP ticket to the annual diversity leadership lectures. More information on the scholarship programme is available via TMBDLF’s website https://www.tmbdlf.com/scholarship-programme.

The categories include Finance and Business, Hogan Lovells ‘Law’, STEAM (Science, Technology, Engineering, Arts and Mathematics), Multi-Sector, Medical, Automotive (for women), Charity, BWOB (Black Women on Boards), LGBTQ+ (Lesbian, Gay, Bisexual, Transgender, Queer etc), Disability and Neurodiversity, From Care (foster and government care systems), ESG (Environment, Social and Governance) with the University of Bath.

Each year we launch new innovative scholarships. This year has included a scholarship called ‘Automotive (for women)’ to celebrate International Women’s Month 2022 and our ESG scholarship has re-launched this year with a University of Bath partnership as part of the One Young World Bath Caucus. Other new innovative scholarships this year include Charity, From Care and Neurodiversity.

A full list of categories and eligibility are also available online. To apply visit the Charity’s website www.tmbdlf.com

The winners will be announced at The Miranda Brawn Diversity Leadership Annual Lecture Event 2022 which will take place later this year in the UK. The date and venue will be confirmed in due course. Further details will be shared on the website by summer 2022. https://www.tmbdlf.com/annual-lecture-and-events

For more information, to support and/or apply for a scholarship, please email TMBDLF’s team directly via info@tmbdlf.com.

Founder Dr Miranda K. Brawn with the Miranda Brawn Diversity Leadership Winners for 2021 at TMBDLF Graduation Group Mentoring Lunch and Etiquette Programme Launch Event held in September 2021 at the Bluebird Restaurant in Chelsea, London UK.

SPAC vs IPO

After more than a decade of buildup, special purpose acquisition companies (SPACs) have exploded and are gaining momentum in the US and beyond.

Special purpose acquisition companies (SPACs) were big news in 2020, breaking records and captivating markets and media alike.

SPACs raised a record US$82.4 billion in 248 US IPOs in 2020, data from Dealogic shows. This compares with US$13.5 billion for 59 IPOs in 2019. In addition, 92 SPACs announced business combinations in 2020, with a total deal value of US$151 billion, up from 27 SPACS with a total deal value of US$27.6 billion in 2019.

Despite sponsor and investor interest from around the globe, SPACs have primarily been a US phenomenon. That may be changing—the London Stock Exchange is weighing possible rule changes to encourage SPAC listings; Nasdaq updated its rules to enable SPAC listings in Stockholm, effective February 1, 2021; and SPAC offerings are in process on Euronext in various European countries.

What Is a Special Purpose Acquisition Company (SPAC)?

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. Also known as “blank check companies”. SPACs have been around for decades. In recent years, they have become more popular, attracting big-name underwriters and investors and raising a record amount of IPO money in 2019. In 2020, as of the beginning of August, more than 50 SPACs have been formed in the U.S. which have raised some $21.5 billion.

What is an IPO and how does it work?

An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. Public share issuance allows a company to raise capital from public investors.

What is the purpose of an IPO?

Companies typically issue an IPO to raise capital to pay off debts, fund growth initiatives, raise their public profile, or to allow company insiders to diversify their holdings or create liquidity by selling all or a portion of their private shares as part of the IPO.

Are SPACs better than IPOs?

Private companies are flocking to SPAC deals for a few big reasons. One is that a typical SPAC comes with a 2% underwriter fee and 3.5% fee at completion compared with 7% for a traditional IPO. The timeline of a SPAC is usually three to four months versus up to a year with a traditional IPO.

How does a SPAC IPO work?

A SPAC raises capital through an initial public offering (IPO) for the purpose of acquiring an existing operating company. Subsequently, an operating company can merge with (or be acquired by) the publicly traded SPAC and become a listed company in lieu of executing its own IPO.

How does a SPAC work?

This is the same as a SPAC IPO. SPACs are generally formed by investors, or sponsors, with expertise in a particular industry or business sector, with the intention of pursuing deals in that area. In creating a SPAC, the founders sometimes have at least one acquisition target in mind, but they do not identify that target to avoid extensive disclosures during the IPO process. (This is why they are called “blank check companies.” IPO investors have no idea what company they ultimately will be investing in.) SPACs seek underwriters and institutional investors before offering shares to the public.

The money SPACs raise in an IPO is placed in an interest-bearing trust account. These funds cannot be disbursed except to complete an acquisition or to return the money to investors if the SPAC is liquidated. A SPAC generally has two years to complete a deal or face liquidation. In some cases, some of the interest earned from the trust can be used as the SPAC’s working capital. After an acquisition, a SPAC is usually listed on one of the major stock exchanges.

Advantages of a SPAC

Selling to a SPAC can be an attractive option for the owners of a smaller company, which are often private equity funds. First, selling to a SPAC can add up to 20% to the sale price compared to a typical private equity deal. Being acquired by a SPAC can also offer business owners what is essentially a faster IPO process under the guidance of an experienced partner, with less worry about the swings in broader market sentiment.

SPACs Make a Comeback

SPACs have become more common in recent years, with their IPO fundraising hitting a record $13.6 billion in 2019—more than four times the $3.2 billion they raised in 2016. They have also attracted big-name underwriters such as Goldman Sachs, Credit Suisse, and Deutsche Bank.

Examples of High-Profile SPAC Deals

One of the most high-profile recent deals involving special purpose acquisition companies involved Richard Branson’s Virgin Galactic. Venture capitalist Chamath Palihapitiya’s SPAC Social Capital Hedosophia Holdings bought a 49% stake in Virgin Galactic for $800 million before listing the company in 2019. In 2020, Bill Ackman, founder of Pershing Square Capital Management, sponsored his own SPAC, Pershing Square Tontine Holdings, the largest-ever SPAC, raising $4 billion in its offering on 22 July.

Hot Sectors

A number of sectors in particular stood out in 2020.

Online gaming

Online gaming has been very active, with several transactions hitting the market in addition to DraftKings. These include the US$3.5 billion transaction between Flying Eagle Acquisition Corp. and Skillz Inc., the US$1.4 billion transaction between dMY Technology Group, Inc. and Rush Street Interactive, LP, and the US$800 million transaction between Landcadia Holdings II, Inc. and Golden Nugget Online Gaming, Inc.

Automotive – Electric Vehicle (EV) and Automotive Technology

The automotive sector, particularly electric vehicle manufacturers and automotive technology, has also been hot. Notable deals include Velodyne Lidar, which announced in early July its plan to merge with the SPAC Graf Industrial Corp. in a deal that valued the combined entity at US$1.8 billion. Velodyne is a supplier of lidar (light, detection and ranging) technology for developers of autonomous vehicles. The deal closed in October.

Life sciences

Life sciences has also been very active, with a number of SPACs launched by life sciences-focused investment funds.

SUMMARY

- A special purpose acquisition company (SPAC) is formed to raise money through an initial public offering to buy another company.

- At the time of their IPOs, SPACs have no existing business operations or even stated targets for acquisition.

- Investors in SPACs can range from well-known private equity funds to the general public.

- SPACs have two years to complete an acquisition or they must return their funds to investors.

ESG Investing, the Electric Vehicle (EV) Automotive industry and SPAC / IPO

Electric Car and Bus Markets

What is ESG?

ESG stands for “environment, social and governance”.

What is ESG Investing?

ESG investing entails researching and factoring in environmental, social, and governance issues, in addition to the usual financials, when evaluating potential stocks for portfolios. Research is increasingly showing that this investing method can reduce portfolio risk, generate competitive investment returns, and help investors feel good about the stocks they own.

There are any number of ways for investors and business leaders to explore the EV or ESG conversation right now. The push for sustainable options in every sector reaches well beyond the automotive industry. The next generation consumer and market intelligence ensures you will see those trends coming and be ready to adapt (or adopt) early.

Electric Vehicles Are The Future

Until recently, mass adoption of Electric Vehicle (EV) technology has been concentrated primarily in the small vehicle category, targeted at reducing the numbers of the highly polluting two- and three-wheelers ubiquitous in Asia’s cities. Through a system of subsidies to encourage mass adoption of these EVs, China has sought to improve air quality throughout its many bustling city-centres.

Policies encouraging adoption of more sustainable behaviours are beginning to shift from incentivising consumers to regulatory enforcement, although the economic impact of COVID-19 has resulted in countries temporarily prioritising economic recovery. Furthermore, pressure to conform to more socially responsible practices is becoming increasingly mainstream.

Whilst China has led adoption of EVs and battery technology in recent years, European consumers and manufacturers are now rapidly turning to EVs, catalysed by incentives seeking to boost economic activity. EVs are generally regarded as ‘green’ technology, however the supply of mineral ingredients for batteries is likely to give rise to new sustainability challenges.

Regulations to Replace Subsidies

Regulations put in place by the Chinese government have increasingly focused on encouraging consumers and manufacturers to switch away from polluting ICEs to cleaner EV technology. Since 2019, China’s vehicle manufacturers have been incentivised to produce and sell greater volumes of their EVs through a system of credits for each unit produced, reflecting factors such as type, energy consumption, weight and range. Manufacturers that do not achieve agreed sales targets must either purchase credits from competitors or face financial penalties.

This subsidy system – introduced in 2012 as part of a push to reduce air pollution in China’s cities – has successfully stimulated EV adoption in the country. However, whilst the system was scheduled to be phased out in 2020, the combined impact of weaker-than-expected EV sales in 2019 and the shock of COVID-19 has meant that the withdrawal of purchase tax exemptions has been deferred until 2022.

The European Union’s 2014 Directive required member states to set targets for public recharging infrastructure; in 2017 it established the Battery Alliance, aimed at fostering co-operation between member states, industry and the European Investment Bank. As the EU has developed its environmental and sustainability policies, a combination of strategic support and regulatory pressure has been developed; for example, in 2019 stakeholders were consulted on how to use regulations to rapidly foster a battery market that provides high quality, cost efficient and competitive products in a sustainable manner.

Adoption

Battery technology limitations have until recently meant high uptake has been limited above all to smaller vehicles, with approximately 350 million two- and three-wheeled EVs in use worldwide, representing 25% of all vehicles in this category globally. Use of these light vehicles has been centred primarily in Chinese cities, although adoption is spreading to other highly-populated cities in India and ASEAN nations.

Electrification of urban bus fleets is also seen as an area of potential growth, as their short routes and driving cycles are compatible with contemporary battery limitations. Globally, there are around half a million electric buses in use, about half of which are in Chinese cities. Extra-urban buses and lorries, however, do not readily lend themselves to electrification due to long distances and charging infrastructure requirements – today’s battery technology simply do not possess the range to make uptake in this sector viable for now.

Electric car global sales in 2019 amounted to 2.1 million, taking the global stock of electric cars to 7.2 million; or 2.6% of global car sales and 1% of global car stocks. As China experienced weak demand continuing into 2020 because of the COVID-19 pandemic, sales in Europe increased significantly, up by 57% in the first half of 2020, even as the overall trend of vehicle sales volumes showed a significant dip (down 37%). This change was mainly in response to European countries introducing new economic recovery schemes targeting green technology, taking European sales volumes ahead of China for the first time.

Automakers are rapidly growing their product ranges while shifting away from plug-in hybrids (PHEVs). In 2019, 143 new EV models were launched, while a further 450 models are expected by 2030, mostly consisting of mid-sized and large vehicles. Although the number of manufacturers and models is rapidly expanding, Tesla retains quite remarkable leadership. In the first half of 2020, global sales of the Tesla Model 3 amounted to 142,000 vehicles while the second most popular EV, the Renault Zoe, achieved a reduced 38,000 unit sales.

McKinsey estimates that by 2030 EVs could account for 20% of global vehicle sales, whereas Deloitte anticipate significant regional variations, with China making up 48% of total sales, Europe 27% and US only 14%.

One of the factors effecting adoption rates is the oil price, as consumers are highly sensitive to costs relative to ICE vehicles. The International Energy Agency calculates an oil price of US$25 per barrel will increase the payback period by 1 – 2.5 years compared to oil price of US$60. Fuel tax policy is also an influence; in countries such as Germany with 60% fuel tax, there is greater incentive to switch away from internal combustion engines than in the US where tax is around 20%.

EV growth rates are expected to slow beyond 2030, as wealthy countries will have substantially adopted the technology as far as is practical. In poorer countries, adoption will be slower due to the significant capital requirements to construct charging infrastructure necessary to make day-to-day use feasible.

New Money

Rare earth miners and uranium producers have enjoyed the flood of new money going into electric vehicles and environmental, social, and governance investment themes as reported by Bloomberg. Lithium producers have traditionally benefited from the growth in the electric vehicle market and the broader green energy push that has raised demand for lithium-ion batteries. More recently, rare earth producers have also gained momentum amid the greater push toward electric vehicles, especially with the Biden administration targeting a zero-emission future more reliant on clean energy alternatives.

There is an accelerating adoption of electric vehicles and electrification trends in wind turbines. Rare earth metals are incorporated in new technologies, from lithium-ion batteries to electric vehicles, wind turbines, and missile guidance systems. There is also limited global supply as only a handful of producers globally produce the metals.

Uranium stocks are now gaining attention from ESG investors due to their low GHG footprint and quintessential role as a clean energy alternative, the set-up for incremental/new Uranium investments as opportune for greenhouse gas emissions.

Young Investors are attracted to the Electric Vehicle market

With new apps available making investing an attainable option for anyone, young investors are increasingly attracted to the electric vehicle market – and to the surrounding conversation. Capturing customer experiences analytics with social listening is critical, as their investment decisions mirror their buying habits. Next generation consumer and market intelligence is key. Millennials love electric vehicles.

Electric Vehicles Batteries

The demand for EV batteries is expected to soar as automakers increasingly comply with emission standards and boost their production of battery electric vehicles (BEVs), according to a new report from Moody’s Investor Service. Tightening regulations and growth of BEVs are also expected to spur improvements in battery capacity. The International Energy Agency projects global battery capacity for BEVs and plug-in hybrid vehicles will grow by 24% on a compounded annual basis between 2020 and 2030.

Top makers of EV batteries, including Contemporary Amperex Technology, LG Chem, Panasonic Corporation and SK Innovation are set to benefit from rising demand. These four account for more than half of global production. However, a sharp rise in production will pose operational risks and increase the challenge of keeping leverage ratios stable, according to the report. As battery makers invest in emerging technology, strong relationships with automakers will be critical for their credit quality.

Makers of EV batteries who maintain solid relationships with automakers that have a clear strategy to expand BEV sales will see their revenue and profit stay stable. Among the four rated battery makers, Amperex Technology’s margin will remain the highest and stay around low double-digits over next 12 to 18 months, thanks to high-capacity utilization and China’s EV subsidies. In comparison, other battery makers’ margins are single-digit or less, according to the report.

Battery Technology

McKinsey estimate the cost of an EV to be made up primarily of the battery pack, accounting for a full 40%-50% of the price while the power train represents another 20%. Lithium-ion (Li-ion) batteries commonly used in EVs presently use cathodes (a negatively charged electrode that’s the source of electrons generating the electrical charge) made from three mineral mixtures, with nickel cobalt aluminium oxide (NCA), nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) being the most prominent.

NMC, however, is the most widely used type due to its energy density properties. Energy density, or the amount of energy held in the battery per unit weight, is highly prized in many EV markets and is largely defined by the nickel content of the battery; this will likely represent one of the ways in which performance will be improved over coming years. On the other hand, it is worth noting that not all batteries are manufactured to optimise energy density. Other considerations such as cost or size constraints may be more important so that usage specifications vary; small battery packs are most common in Asia, whilst in Europe and US batteries are larger.

In the years since 2010, battery costs have fallen from US$1,000 kWh to US$147 kWh. Bloomberg New Energy Finance expects these will fall to around US$100 in 2023/4 and US$61 by 2030. It has been reported that Tesla is now working with Chinese battery manufacturer CATL on LPF battery technology which could reduce costs below the US$100 per kWh mark, helping to achieve cost parity with ICEs.

Sustainability

Recycling regulations primarily focus on making battery manufacturers responsible for waste through the entire life-cycle until scrapped, referred to as Extended Producer Responsibility (EPR). Batteries are also recycled by converting used packs for lower specification EVs, or reconfigured as part of electrical storage facilities.

In China, companies are mainly focused on recycling materials in preference to repurposing used batteries, in response to regulations and shortages in supply of lithium, 85% of which is imported. In 2020 the EU brought forward new regulations intended to protect and improve the environment by minimising adverse impacts of batteries through prohibiting certain materials and requiring battery producers to take responsibility for end collection and recycling. In the US, waste regulation is primarily set at the state level, with certain states having introduced battery recycling and disposal laws, while others have applied EPR principles.

While EVs are effective in reducing harmful air pollutants, large scale use of minerals such as cobalt and nickel bring their own challenges. High quality nickel, one of the main components of modern batteries, is extracted from rock containing just 1% of usable material. Such high quantities of waste product are potentially a major environmental concern; with increased demand its expected production will shift from Canada and Australia to Indonesia, where mining firms will have to sustainably dispose of large volumes of waste to ensure Indonesia’s seas with their rich coral reefs and turtles are not endangered.

Regulation, Technology and Investments

Impressive statistics on the rollout of electric vehicles (EVs) are the result of regulation, technological improvements, and greater investment in EV supply chains. But accessible, efficient, and low-cost charging infrastructure remains a prerequisite for widespread EV adoption; deploying this infrastructure efficiently and achieving target return rates will be more complex than immediately apparent.

Highlighting the magnitude of the transformation required to manage climate change, there is a commitment to cut net carbon emissions to zero within the next few decades. Zero-carbon transport is just one of the requirements for achieving this goal. Immense changes to power generation, heating, agriculture, and manufacturing will also be required.

Biggest Tech Breakthrough in a Generation

The early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by new devices. In the process, it is expected to create 22 million jobs and generate $12.3 trillion in activity.

Charging points

Charging points are a vital aspect of the overall shift towards the electrification of transport. Various forecasts put the number of EVs on UK roads at between two and six million by 2030. EV drivers will seek to have residential chargers installed in their homes wherever that is an option: around 57% of UK households currently park on a driveway or in a domestic garage. Technical guidance from the EU recommends one public charger per 10 electric vehicles. This means hundreds of thousands of public chargers will be needed to enable the expected deployment of EVs, an exponential rise from the current level of roughly 20,000.

Competition to install the charging points is already intensifying as early entrants seek to gain advantage and capture market share. Car makers increasingly see the provision of ancillary services as paving the way for vehicle sales growth. Energy companies are increasingly looking to diversify their fossil-fuel exposure too, while utilities see synergies with their traditional energy-supply businesses. Finally, independent specialists have emerged who are seeking to capture market share and provide solutions for corporate clients such as shopping malls, supermarkets, fleet operators, and large employers.

The residential charging market is attractive to EV installers due to its large size and growth prospects. It is becoming increasingly commoditised, though, with low barriers to entry enabling increased competition and pressuring margins. Achieving economies of scale will be the key challenge for developers in this market segment.

On the other hand, public charging networks – particularly rapid charging – feature higher barriers to entry and potentially more stable revenues in the future. Location is crucial for this: some places, such as motorway service stations, have a more stable base of captive users than others like carparks or retail and leisure locations. Low utilisation is the main challenge for these assets, as preliminary data suggest around 80-90% of charging is conducted at home. Rapid chargers are seldom used even in markets such as Norway, where the EV transition is well under way. Furthermore, fast public charging can require significant upfront investment, not least in power network upgrades.

The good news for investors is that EV adoption is intensifying and creating a large market for the build out of ancillary infrastructure. Clarity on user behaviour and competitive dynamics will develop over the next five to 10 years. In the meantime, investors in charging infrastructure will need the patience to develop an in-depth understanding of consumer behaviour, the interaction between location and utilisation, and a tolerance for risk.

Electric Bus and Public Transportation Market

The electric bus market size exceeded $28 billion in 2020 and is expected to grow at 11% compound annual growth rate (CAGR) between 2021 and 2027. The market is forecast to grow at an exponential rate due to the rapid increase in uptake of electric buses as a sustainable mode of transport according to a new report by Global Market Insights (GMI).

Electric buses are primarily operated by the integrated electric batteries. This also includes plug-in hybrid buses and fuel-cell electric buses. The report says stringent emission regulations and directives imposed by governments across the globe will propel the adoption of electric buses. In 2019, France announced its 100% zero-emission vehicle target for 2040. As a part of the Paris Climate agreement, the country passed a law to ban ICE vehicle sales by 2040.

Electric buses are 100% eco-friendly as they operate on electrically-powered engines. They do not release smoke or toxic gases into the environment as they operate on a clean energy obtained from battery packs. Several benefits of electric buses, such as low maintenance costs and reduced pollution by emissions, are augmenting their representation in the market.

The increasing focus of several countries, such as India, China, and Canada, on promoting electrification of public transport is providing lucrative growth opportunities, according to GMI. Initiatives undertaken by several governments to reduce the carbon footprint of public transportation are boosting the electric bus market size through 2027.

The electric bus industry alongside every other industry has been impacted by the prevailing situations of COVID-19. The manufacturing of electric buses has been affected and sales numbers also decreased because of mass quarantines and lockdown during the first two quarters of 2020. Industry players have faced challenges on account of shortage of capital and financial insecurities caused by the decline in revenues. However, the market is expected to witness steady growth subject to the revival of global economic conditions in 2021, supported by policy changes and government support.

SPAC Merger Became the Trendiest EV IPO Route of 2020

The demand for electric vehicles (EVs) is fueling on the back of climate change concerns, favourable government policies and superior technologies. Investors are intrigued by automakers that look for solutions to lower global carbon emissions for providing a cleaner energy future. With green vehicles striking the right chord with investors, it has been raining IPOs in the EV market during the past year. Seemingly, merger with special purpose acquisition companies (SPACs) turned out to be the most popular course of action for an EV IPO in 2020.

What is a SPAC?

SPACs, or blank-check companies, are shell vehicles that raise money to take a private company public via a reverse merger. Unlike traditional initial public offerings (IPOs), SPAC deals allow listing candidates to market financial projections to investors, a perk for earlier stage companies that have yet to prove their business model.

SPACs have changed the traditional IPO market. SPACs are flourishing in the EV market, helping startups to avoid the complexity and strenuous paperwork associated with the traditional IPO. Many EV companies chose to go public in 2020 via reverse mergers with SPACs, a faster, simpler and less demanding process than the conventional means of making a debut on the stock market.

Electric-vehicle companies, many of which are yet to launch commercial products, have taken advantage of that. Nikola Corp was the first high profile one to go public via a SPAC listing, followed by others including Lordstown Motors Corp, Fisker Inc and Canoo Inc. U.S. listings have dominated the SPAC boom, but Europe’s stock exchanges are now catching up. The IPOX SPAC Index tracks the performance of a broad group of blank-check companies.

Conclusion

The early stages of adoption by users of medium and large cars has commenced, with higher sales volumes shifting from China to Europe. At present, volumes of battery-powered EV sales are small as a proportion of global vehicle sales, although rapidly rising; Tesla retains leadership and dominates the mid- and large-sized EV market. Higher levels of adoption are expected in wealthier nations where the significant cost of recharging infrastructure can be financed.

Governments around the world are embracing EVs as a green technology that reduces harmful air pollutants and are putting regulations in place which make battery manufacturers responsible for their products throughout their entire lifecycle. As consumers become more aware of the environmental impact of their actions and governments face growing liabilities from air pollution, adaption in many countries is now regarded as a necessity rather than a lifestyle choice.

Additionally, merger with special purpose acquisition companies (SPACs) has good prospects to continue with the 2020 popularity course of action for an EV IPO.

With the election of President Biden, who has signalled his commitment to sustainability by rapidly moving to re-join the Paris Agreement and appointing John Kerry as the special envoy on climate change, there is now the prospect the US will join China and Europe in forcing further change.